News

12.02.2026

Startē “Baltijas Inovāciju fonds 3” (BIF 3)

European Investment Fund (EIF) sadarbībā ar Igauniju, Latviju un Lietuvu uzsāk 225 miljonu eiro vērtu iniciatīvu, lai stiprinātu Baltijas reģiona privātā un iespējkapitāla tirgu.

16.07.2025

Startē “Baltijas Inovāciju fonds 3” (BIF 3)

European Investment Fund (EIF) sadarbībā ar Igauniju, Latviju un Lietuvu uzsāk 225 miljonu eiro vērtu iniciatīvu, lai stiprinātu Baltijas reģiona privātā un iespējkapitāla tirgu.

16.07.2025

Ceļojošā izstāde 'Mūsu uzņēmumi veido nākotni' skatāma iepirkšanās un izklaides centrā AKROPOLE Alfa

Esam priecīgi paziņot, ka izstāde "Mūsu uzņēmumi veido nākotni" no rītdienas - 17.jūlija būs apskatāma iepirkšanās un izklaides centrā AKROPOLE Alfa!

13.06.2025

Ceļojošā izstāde 'Mūsu uzņēmumi veido nākotni' skatāma iepirkšanās un izklaides centrā AKROPOLE Alfa

Esam priecīgi paziņot, ka izstāde "Mūsu uzņēmumi veido nākotni" no rītdienas - 17.jūlija būs apskatāma iepirkšanās un izklaides centrā AKROPOLE Alfa!

13.06.2025

Baltic VCA Summit 2025

Each year Baltic Private Equity & Venture Capital professionals gather at one of the beautiful Baltic cities, discuss industry developments and cooperation, network and enjoy summer & various activities together. LVCA is very excited to be the host of Baltic VCA Summit 2025 and to welcome you in Riga on the 4-5 of September.

12.06.2025

Baltic VCA Summit 2025

Each year Baltic Private Equity & Venture Capital professionals gather at one of the beautiful Baltic cities, discuss industry developments and cooperation, network and enjoy summer & various activities together. LVCA is very excited to be the host of Baltic VCA Summit 2025 and to welcome you in Riga on the 4-5 of September.

12.06.2025

FNA un LVCA vienojas par pensiju fondu ieguldījumiem Latvijas izaugsmei

Latvijas Finanšu nozares asociācija (FNA) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) parakstīja sadarbības memorandu, lai veicinātu pensiju fondu dalībnieku interesēm atbilstošus ieguldījumus Latvijas uzņēmumos un projektos.

23.04.2025

FNA un LVCA vienojas par pensiju fondu ieguldījumiem Latvijas izaugsmei

Latvijas Finanšu nozares asociācija (FNA) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) parakstīja sadarbības memorandu, lai veicinātu pensiju fondu dalībnieku interesēm atbilstošus ieguldījumus Latvijas uzņēmumos un projektos.

23.04.2025

16.maijā norisināsies pasākums “Gada investors 2024”

Ceremonijā “Gada investors 2024”, kas 16. maijā norisināsies Rīgas Cirkā, tiks godināti

nozīmīgākie investīciju projekti un privātie investori, kuri 2024. gadā devuši būtisku ieguldījumu

Latvijas jaunuzņēmumu izaugsmē.

07.03.2025

16.maijā norisināsies pasākums “Gada investors 2024”

Ceremonijā “Gada investors 2024”, kas 16. maijā norisināsies Rīgas Cirkā, tiks godināti

nozīmīgākie investīciju projekti un privātie investori, kuri 2024. gadā devuši būtisku ieguldījumu

Latvijas jaunuzņēmumu izaugsmē.

07.03.2025

Jau otro gadu pēc kārtas startēs LVCA x SSER sadarbībā veidots kurss - “Introduction to Private Equity and Venture Capital”

Priecīgas ziņas - ir iespēja pieteikties un apmeklēt 2025.gada pavasarī LVCA x SSER sadarbībā veidotu kursu - “Introduction to Private Equity and Venture Capital”!

Jau otro gadu pēc kārtas startēs LVCA x SSER sadarbībā veidots kurss - “Introduction to Private Equity and Venture Capital”

Priecīgas ziņas - ir iespēja pieteikties un apmeklēt 2025.gada pavasarī LVCA x SSER sadarbībā veidotu kursu - “Introduction to Private Equity and Venture Capital”!

Startē “Baltijas Inovāciju fonds 3” (BIF 3)

European Investment Fund (EIF) sadarbībā ar Igauniju, Latviju un Lietuvu uzsāk 225 miljonu eiro vērtu iniciatīvu, lai stiprinātu Baltijas reģiona privātā un iespējkapitāla tirgu.

16.07.2025

Startē “Baltijas Inovāciju fonds 3” (BIF 3)

European Investment Fund (EIF) sadarbībā ar Igauniju, Latviju un Lietuvu uzsāk 225 miljonu eiro vērtu iniciatīvu, lai stiprinātu Baltijas reģiona privātā un iespējkapitāla tirgu.

16.07.2025

Ceļojošā izstāde 'Mūsu uzņēmumi veido nākotni' skatāma iepirkšanās un izklaides centrā AKROPOLE Alfa

Esam priecīgi paziņot, ka izstāde "Mūsu uzņēmumi veido nākotni" no rītdienas - 17.jūlija būs apskatāma iepirkšanās un izklaides centrā AKROPOLE Alfa!

13.06.2025

Ceļojošā izstāde 'Mūsu uzņēmumi veido nākotni' skatāma iepirkšanās un izklaides centrā AKROPOLE Alfa

Esam priecīgi paziņot, ka izstāde "Mūsu uzņēmumi veido nākotni" no rītdienas - 17.jūlija būs apskatāma iepirkšanās un izklaides centrā AKROPOLE Alfa!

13.06.2025

Baltic VCA Summit 2025

Each year Baltic Private Equity & Venture Capital professionals gather at one of the beautiful Baltic cities, discuss industry developments and cooperation, network and enjoy summer & various activities together. LVCA is very excited to be the host of Baltic VCA Summit 2025 and to welcome you in Riga on the 4-5 of September.

12.06.2025

Baltic VCA Summit 2025

Each year Baltic Private Equity & Venture Capital professionals gather at one of the beautiful Baltic cities, discuss industry developments and cooperation, network and enjoy summer & various activities together. LVCA is very excited to be the host of Baltic VCA Summit 2025 and to welcome you in Riga on the 4-5 of September.

12.06.2025

FNA un LVCA vienojas par pensiju fondu ieguldījumiem Latvijas izaugsmei

Latvijas Finanšu nozares asociācija (FNA) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) parakstīja sadarbības memorandu, lai veicinātu pensiju fondu dalībnieku interesēm atbilstošus ieguldījumus Latvijas uzņēmumos un projektos.

23.04.2025

FNA un LVCA vienojas par pensiju fondu ieguldījumiem Latvijas izaugsmei

Latvijas Finanšu nozares asociācija (FNA) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) parakstīja sadarbības memorandu, lai veicinātu pensiju fondu dalībnieku interesēm atbilstošus ieguldījumus Latvijas uzņēmumos un projektos.

23.04.2025

16.maijā norisināsies pasākums “Gada investors 2024”

Ceremonijā “Gada investors 2024”, kas 16. maijā norisināsies Rīgas Cirkā, tiks godināti

nozīmīgākie investīciju projekti un privātie investori, kuri 2024. gadā devuši būtisku ieguldījumu

Latvijas jaunuzņēmumu izaugsmē.

07.03.2025

16.maijā norisināsies pasākums “Gada investors 2024”

Ceremonijā “Gada investors 2024”, kas 16. maijā norisināsies Rīgas Cirkā, tiks godināti

nozīmīgākie investīciju projekti un privātie investori, kuri 2024. gadā devuši būtisku ieguldījumu

Latvijas jaunuzņēmumu izaugsmē.

07.03.2025

Jau otro gadu pēc kārtas startēs LVCA x SSER sadarbībā veidots kurss - “Introduction to Private Equity and Venture Capital”

Priecīgas ziņas - ir iespēja pieteikties un apmeklēt 2025.gada pavasarī LVCA x SSER sadarbībā veidotu kursu - “Introduction to Private Equity and Venture Capital”!

Jau otro gadu pēc kārtas startēs LVCA x SSER sadarbībā veidots kurss - “Introduction to Private Equity and Venture Capital”

Priecīgas ziņas - ir iespēja pieteikties un apmeklēt 2025.gada pavasarī LVCA x SSER sadarbībā veidotu kursu - “Introduction to Private Equity and Venture Capital”!

14.10.2024

Ceļojošā izstāde “Mūsu uzņēmumi veido nākotni” oktobrī skatāma pašā Rīgas sirdī - Rātsnamā

Notekūdeņu pārvēršana enerģijā, automātiska ravēšana, robotizēta vēja turbīnu apkopšana, ādas tipu noteikšana ar mākslīgo intelektu un virkne citu Latvijā radītu tehnoloģiju ir daļa no izstādes “Mūsu uzņēmumi veido nākotni”, kas tagad līdz 27.

oktobrim apskatāma Rīgas rātsnamā.

26.09.2024

Ceļojošā izstāde “Mūsu uzņēmumi veido nākotni” oktobrī skatāma pašā Rīgas sirdī - Rātsnamā

Notekūdeņu pārvēršana enerģijā, automātiska ravēšana, robotizēta vēja turbīnu apkopšana, ādas tipu noteikšana ar mākslīgo intelektu un virkne citu Latvijā radītu tehnoloģiju ir daļa no izstādes “Mūsu uzņēmumi veido nākotni”, kas tagad līdz 27.

oktobrim apskatāma Rīgas rātsnamā.

26.09.2024

Izstāde "Mūsu uzņēmumi veido nākotni" turpina ceļot un patreiz skatāma Latvijas Bankas darbiniekiem

Septembris nāk ar jaunu lokāciju mūsu ceļojošajai izstādei “Mūsu uzņēmumi veido nākotni”! Tā skatāma Latvijas Banka telpās, K.Valdemāra ielā 1B, Rīgā.

17.09.2024

Izstāde "Mūsu uzņēmumi veido nākotni" turpina ceļot un patreiz skatāma Latvijas Bankas darbiniekiem

Septembris nāk ar jaunu lokāciju mūsu ceļojošajai izstādei “Mūsu uzņēmumi veido nākotni”! Tā skatāma Latvijas Banka telpās, K.Valdemāra ielā 1B, Rīgā.

17.09.2024

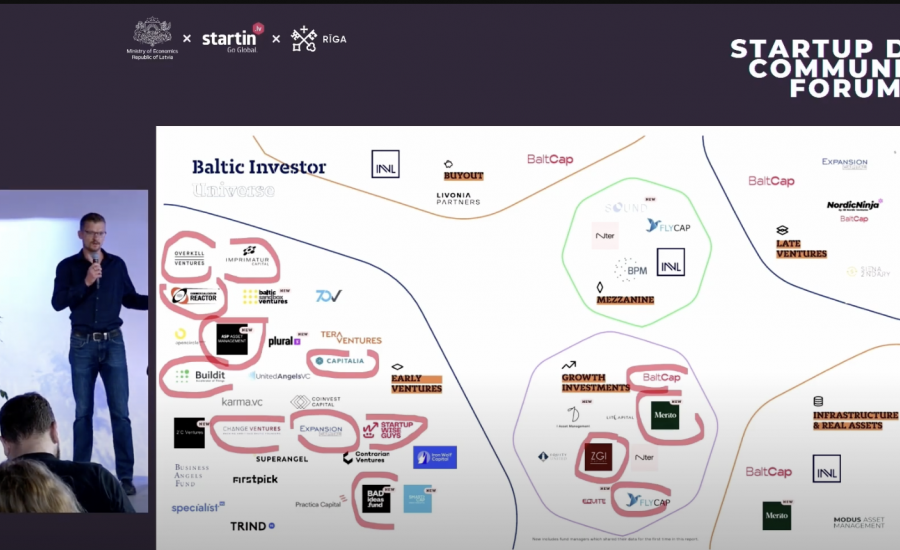

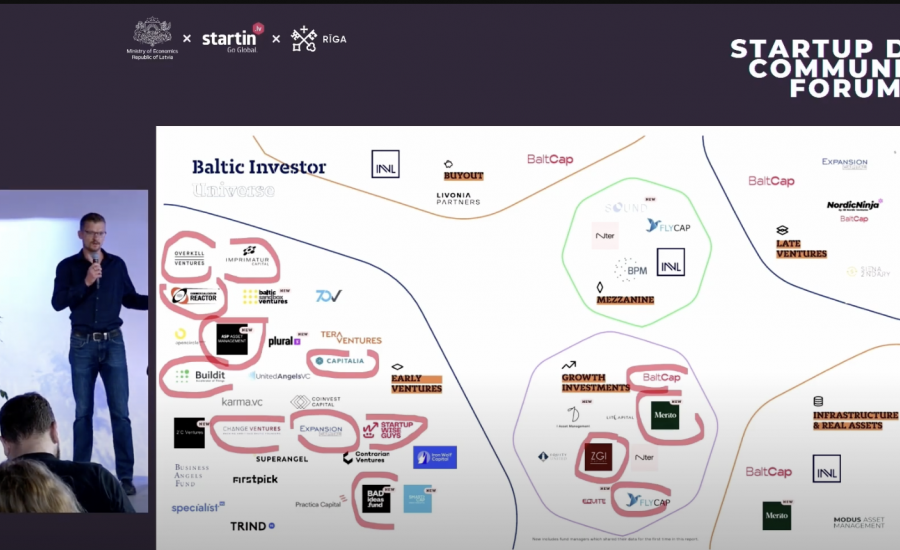

Our board member Matiss Neimanis participated at the Community Forum at Startup House Riga

Matīss Neimanis talked about LVCA, Baltic investors and some success stories within the industry.

04.09.2024

Our board member Matiss Neimanis participated at the Community Forum at Startup House Riga

Matīss Neimanis talked about LVCA, Baltic investors and some success stories within the industry.

04.09.2024

Apsveicam ALTUM 5.paaudzes pirmssēklas un sēklas kapitāla fondu pārvaldnieku atlases konkursa uzvarētājus!

Attīstības finanšu institūcijas “Altum” publiskajā pirmssēklas un sēklas stadijas iespējkapitāla fondu pārvaldnieku atlases iepirkumā tiesības slēgt līgumu piešķirtas trīs fondu pārvaldniekiem: “BADideas.fund”, “Vntrs Consulting” un “Buildit”.

27.06.2024

Apsveicam ALTUM 5.paaudzes pirmssēklas un sēklas kapitāla fondu pārvaldnieku atlases konkursa uzvarētājus!

Attīstības finanšu institūcijas “Altum” publiskajā pirmssēklas un sēklas stadijas iespējkapitāla fondu pārvaldnieku atlases iepirkumā tiesības slēgt līgumu piešķirtas trīs fondu pārvaldniekiem: “BADideas.fund”, “Vntrs Consulting” un “Buildit”.

27.06.2024

Izstāde 'Mūsu uzņēmumi veido nākotni' šobrīd skatāma Verdē!

Izstāde līdz 2.jūlijam skatāma biroju kompleksa VERDE 0. stāva lobijā

05.06.2024

Izstāde 'Mūsu uzņēmumi veido nākotni' šobrīd skatāma Verdē!

Izstāde līdz 2.jūlijam skatāma biroju kompleksa VERDE 0. stāva lobijā

05.06.2024

LVCA organises training for Latvian AIF managers on ESG issues

Happy to share that with knowledge of PwC Latvija experts and financial support of Ekonomikas ministrija/ Ministry of Economics we will provide training for Latvian alternative investment funds (AIF) managers on ESG issues.

31.05.2024

LVCA organises training for Latvian AIF managers on ESG issues

Happy to share that with knowledge of PwC Latvija experts and financial support of Ekonomikas ministrija/ Ministry of Economics we will provide training for Latvian alternative investment funds (AIF) managers on ESG issues.

31.05.2024

Izstāde "Mūsu uzņēmumi veido nākotni"

LVCA sadarbībā ar ALTUM ir izveidojusi pārvietojamu izstādi “Mūsu uzņēmumi veido nākotni”. Izstādē apkopoti deviņu Latvijā dzimušu un ar Latvijas iespējkapitāla fondu palīdzību attīstītu uzņēmumu iedvesmas stāsti.

23.05.2024

Izstāde "Mūsu uzņēmumi veido nākotni"

LVCA sadarbībā ar ALTUM ir izveidojusi pārvietojamu izstādi “Mūsu uzņēmumi veido nākotni”. Izstādē apkopoti deviņu Latvijā dzimušu un ar Latvijas iespējkapitāla fondu palīdzību attīstītu uzņēmumu iedvesmas stāsti.

23.05.2024

Baltic PE/VC Market Overview 2023 is now available!

The report has been prepared by the Baltic VCAs and KPMG Baltics for the 5th time, but his year’s report marks the achievement of an important milestone as the total number of active funds reported surpasses 100 for the first time in the reports' history.

07.05.2024

Baltic PE/VC Market Overview 2023 is now available!

The report has been prepared by the Baltic VCAs and KPMG Baltics for the 5th time, but his year’s report marks the achievement of an important milestone as the total number of active funds reported surpasses 100 for the first time in the reports' history.

07.05.2024

Launch of the Baltic PE/VC Market Overview 2023!

Please join us for the exclusive launch of the Baltic PE/VC Market Overview 2023! The report features an insight into FUNDRAISING, INVESTMENTS, DIVESTMENTS, ESG, and much more from around 100 active PE/VC investors in the Baltics! Thanks so much to all our members for contributing to the report with data and insights!

30.04.2024

Launch of the Baltic PE/VC Market Overview 2023!

Please join us for the exclusive launch of the Baltic PE/VC Market Overview 2023! The report features an insight into FUNDRAISING, INVESTMENTS, DIVESTMENTS, ESG, and much more from around 100 active PE/VC investors in the Baltics! Thanks so much to all our members for contributing to the report with data and insights!

30.04.2024

Winners of the Investor of the Year 2023 awards

On April 19, 2024, LatBAN and Latvian Private Equity and Venture Capital Association (LVCA) organized the annual ceremony "Gada Investors 2023"

12.04.2024

Winners of the Investor of the Year 2023 awards

On April 19, 2024, LatBAN and Latvian Private Equity and Venture Capital Association (LVCA) organized the annual ceremony "Gada Investors 2023"

12.04.2024

Izziņoti visi "Gada investors 2023" nominanti!

Pasākuma “Gada investors 2023” laikā tiks apbalvoti pērnā gada nozīmīgākie investīciju projekti Latvijā deviņās nominācijās. Apbalvojumi tiks pasniegti investīciju projektiem, ko veikuši privātie un institucionālie investori, kā arī finanšu un juridiskajiem konsultantiem par šo darījumu konsultēšanu. "Gada investors 2023" tiek rīkots sadarbībā ar Ekonomikas ministriju, investīciju banku "Signet Bank", Rīgas investīciju un tūrisma aģentūru un “Attīstības finanšu institūciju ALTUM””.

12.03.2024

Izziņoti visi "Gada investors 2023" nominanti!

Pasākuma “Gada investors 2023” laikā tiks apbalvoti pērnā gada nozīmīgākie investīciju projekti Latvijā deviņās nominācijās. Apbalvojumi tiks pasniegti investīciju projektiem, ko veikuši privātie un institucionālie investori, kā arī finanšu un juridiskajiem konsultantiem par šo darījumu konsultēšanu. "Gada investors 2023" tiek rīkots sadarbībā ar Ekonomikas ministriju, investīciju banku "Signet Bank", Rīgas investīciju un tūrisma aģentūru un “Attīstības finanšu institūciju ALTUM””.

12.03.2024

SSE Riga x LVCA launching a new course "Introduction to Private Equity and Venture Capital"

We are very honoured to announce that this spring we are launching a course "Introduction to Private Equity and Venture Capital" - created in cooperation between Rīgas Ekonomikas augstskola - Stockholm School of Economics in Riga and LVCA.

It will consist of 7 lectures during which SSE Riga students as well as our Association members will be given the opportunity to gain, learn and structure knowledge about the industry.

05.03.2024

SSE Riga x LVCA launching a new course "Introduction to Private Equity and Venture Capital"

We are very honoured to announce that this spring we are launching a course "Introduction to Private Equity and Venture Capital" - created in cooperation between Rīgas Ekonomikas augstskola - Stockholm School of Economics in Riga and LVCA.

It will consist of 7 lectures during which SSE Riga students as well as our Association members will be given the opportunity to gain, learn and structure knowledge about the industry.

05.03.2024

Izsludināta pieteikšanās apbalvojumam “Gada investors 2023”

Latvijas Biznesa Eņģeļu Tīkls (LatBAN) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) izsludina pieteikšanos apbalvojumam “Gada investors 2023” par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Apbalvojumam līdz 12.martam var pieteikt investīcijas, ko veikuši privātie investori (komerceņģeļi), juridiskie un institucionālie investori, kā arī finanšu un juridiskos konsultantus par šo darījumu konsultēšanu.

27.02.2024

Izsludināta pieteikšanās apbalvojumam “Gada investors 2023”

Latvijas Biznesa Eņģeļu Tīkls (LatBAN) un Latvijas Privātā un Iespējkapitāla asociācija (LVCA) izsludina pieteikšanos apbalvojumam “Gada investors 2023” par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Apbalvojumam līdz 12.martam var pieteikt investīcijas, ko veikuši privātie investori (komerceņģeļi), juridiskie un institucionālie investori, kā arī finanšu un juridiskos konsultantus par šo darījumu konsultēšanu.

27.02.2024

Pieejams vebināra ieraksts par Blue Bridge Technologies

Vebinārā iespējams uzzināt par to, kā Blue Bridge Technologies kļūt par Latvijas medicīnas nozarē vadošo programmatūras izstrādātāju.

Blue Bridge Technologies ir jaunuzņēmums, kas saņēma Imprimatur sēklas fonda atbalstu un vēlāk attīstīts ar Imprimatur un BaltCap kopīgiem spēkiem. 2022.gadā šo - toreiz jau Latvijas medicīnas nozarē vadošo programmatūras izstrādātāju - iegādājās Everfield.

16.01.2024

Pieejams vebināra ieraksts par Blue Bridge Technologies

Vebinārā iespējams uzzināt par to, kā Blue Bridge Technologies kļūt par Latvijas medicīnas nozarē vadošo programmatūras izstrādātāju.

Blue Bridge Technologies ir jaunuzņēmums, kas saņēma Imprimatur sēklas fonda atbalstu un vēlāk attīstīts ar Imprimatur un BaltCap kopīgiem spēkiem. 2022.gadā šo - toreiz jau Latvijas medicīnas nozarē vadošo programmatūras izstrādātāju - iegādājās Everfield.

16.01.2024

Livonia Partners announces strategic investment in leading UC&C technology provider Wildix

Livonia Partners is excited to announce its investment in Estonian-headquartered Wildix, a pioneer in Unified Communications & Collaboration (UC&C) technology and the only European UCaaS vendor recognized in the Gartner Magic Quadrant. This funding, a first of its kind from an external investor for Wildix, signals a significant leap forward for Wildix.

16.01.2024

Livonia Partners announces strategic investment in leading UC&C technology provider Wildix

Livonia Partners is excited to announce its investment in Estonian-headquartered Wildix, a pioneer in Unified Communications & Collaboration (UC&C) technology and the only European UCaaS vendor recognized in the Gartner Magic Quadrant. This funding, a first of its kind from an external investor for Wildix, signals a significant leap forward for Wildix.

16.01.2024

Livonia Partners invests in Digital Mind to jointly acquire the leading Polish Microsoft Dynamics partner EIP Dynamics

Livonia Partners will invest in Digital Mind AS, a business process digitalization specialist for large and mid-sized organizations in the Baltic states, to facilitate the acquisition of 100% shares of EIP Dynamics Sp. z o.o, a prominent Microsoft Enterprise Resource Planning (ERP) solution provider in Poland serving some of the largest companies in the country and internationally.

05.01.2024

Livonia Partners invests in Digital Mind to jointly acquire the leading Polish Microsoft Dynamics partner EIP Dynamics

Livonia Partners will invest in Digital Mind AS, a business process digitalization specialist for large and mid-sized organizations in the Baltic states, to facilitate the acquisition of 100% shares of EIP Dynamics Sp. z o.o, a prominent Microsoft Enterprise Resource Planning (ERP) solution provider in Poland serving some of the largest companies in the country and internationally.

05.01.2024

FlyCap aizdevums veicinās Latvijas jaunuzņēma Supliful attīstību

Latvijas jaunuzņēmums "Supliful", kas nodarbojas ar kosmētikas, uztura bagātinātāju un pakotās pārtikas produktu ražošanu un piegādi pēc pasūtījuma, vienojies, ka iespējkapitālfonds "FlyCap" izsniegs tam mezanīna aizdevumu līdz diviem miljoniem eiro.

19.10.2023

FlyCap aizdevums veicinās Latvijas jaunuzņēma Supliful attīstību

Latvijas jaunuzņēmums "Supliful", kas nodarbojas ar kosmētikas, uztura bagātinātāju un pakotās pārtikas produktu ražošanu un piegādi pēc pasūtījuma, vienojies, ka iespējkapitālfonds "FlyCap" izsniegs tam mezanīna aizdevumu līdz diviem miljoniem eiro.

19.10.2023

BaltCap launches €200 million successor infrastructure fund

BaltCap, the largest private equity fund manager in the Baltics, held the first closing of its €200 million target BaltCap Infrastructure Fund II (BInF II). The 20-year successor fund aims to contribute to increasing the resilience of the region with a focus on renewable energy generation, energy demand reduction, and social as well as transport infrastructure investments in the Baltics and Poland. The fund is an Article 9 fund under the EU Sustainable Finance Disclosure Regulation.

19.10.2023

BaltCap launches €200 million successor infrastructure fund

BaltCap, the largest private equity fund manager in the Baltics, held the first closing of its €200 million target BaltCap Infrastructure Fund II (BInF II). The 20-year successor fund aims to contribute to increasing the resilience of the region with a focus on renewable energy generation, energy demand reduction, and social as well as transport infrastructure investments in the Baltics and Poland. The fund is an Article 9 fund under the EU Sustainable Finance Disclosure Regulation.

19.10.2023

'FlyCap' piešķir 1,5 miljonu eiro aizdevumu 'Energokomplekss' grupai

Enerģētikas nozares uzņēmums "Energokomplekss grupa" ir saņēmis 1,5 miljonu eiro mezanīna aizdevumu krājumu un apgrozāmo līdzekļu finansēšanai no izaugsmes kapitāla fonda "FlyCap Mezzanine Fund II AIF KS".

07.10.2023

'FlyCap' piešķir 1,5 miljonu eiro aizdevumu 'Energokomplekss' grupai

Enerģētikas nozares uzņēmums "Energokomplekss grupa" ir saņēmis 1,5 miljonu eiro mezanīna aizdevumu krājumu un apgrozāmo līdzekļu finansēšanai no izaugsmes kapitāla fonda "FlyCap Mezzanine Fund II AIF KS".

07.10.2023

Pieejams ALTUM iespējkapitāla apskats

2023. gads ir iezīmējis attīstību vairākos iespējkapitāla nozares virzienos – papildus esošo 4. paaudzes fondu apguvei, ir notikusi nozīmīga virzība 5. paaudzes un IPO fondu programmās

02.10.2023

Pieejams ALTUM iespējkapitāla apskats

2023. gads ir iezīmējis attīstību vairākos iespējkapitāla nozares virzienos – papildus esošo 4. paaudzes fondu apguvei, ir notikusi nozīmīga virzība 5. paaudzes un IPO fondu programmās

02.10.2023

NCH Baltics Opportunity Fund I AIF Acquires Warehouse Complex on Ganību Dambis 25d for 2.6 Million Euros

NCH Baltics AIFP, the fund manager for the NCH Baltics Opportunity Fund I AIF (the “Fund"), announces the acquisition of its second property – a warehouse and office complex on Ganibu Dambis 25d in Riga, Latvia.

06.09.2023

NCH Baltics Opportunity Fund I AIF Acquires Warehouse Complex on Ganību Dambis 25d for 2.6 Million Euros

NCH Baltics AIFP, the fund manager for the NCH Baltics Opportunity Fund I AIF (the “Fund"), announces the acquisition of its second property – a warehouse and office complex on Ganibu Dambis 25d in Riga, Latvia.

06.09.2023

Two solar power plants in Valmiera and Saldus backed by AJP Capital and BaltCap completed

In August this year, finishing works in the construction of two solar power plants in Valmiera and Saldus regions, developed by the energy group AJ Power and backed by AJP Capital and BaltCap, were completed. The combined capacity of the two solar parks exceeds 11 MW, which will generate more than 10,000 MWh of green electricity for households and industrial enterprises per year. Both power plants have already been successfully connected to the unified electricity grid and the first month's results show high productivity rates.

03.08.2023

Two solar power plants in Valmiera and Saldus backed by AJP Capital and BaltCap completed

In August this year, finishing works in the construction of two solar power plants in Valmiera and Saldus regions, developed by the energy group AJ Power and backed by AJP Capital and BaltCap, were completed. The combined capacity of the two solar parks exceeds 11 MW, which will generate more than 10,000 MWh of green electricity for households and industrial enterprises per year. Both power plants have already been successfully connected to the unified electricity grid and the first month's results show high productivity rates.

03.08.2023

BaltCap and Draugiem Capital become majority shareholders of IGLU brand developer Pepi Rer

BaltCap, the largest private equity fund manager in the Baltics, and investment company Draugiem Capital invest in Latvia-based multi-sector production company SIA Pepi Rer to boost the global expansion of the business. Pepi Rer is widely known for its soft play brand IGLU, floor insulation brand ProVent, as well as the production of construction and packaging materials. After the transaction, BaltCap and Draugiem Capital will become the majority shareholders of the company.

26.07.2023

BaltCap and Draugiem Capital become majority shareholders of IGLU brand developer Pepi Rer

BaltCap, the largest private equity fund manager in the Baltics, and investment company Draugiem Capital invest in Latvia-based multi-sector production company SIA Pepi Rer to boost the global expansion of the business. Pepi Rer is widely known for its soft play brand IGLU, floor insulation brand ProVent, as well as the production of construction and packaging materials. After the transaction, BaltCap and Draugiem Capital will become the majority shareholders of the company.

26.07.2023

BaltCap completes the first take-private transaction by a Baltic investor on the London Stock Exchange by acquiring Xpediator

BaltCap, the largest private equity fund manager in the Baltics, with co-investors, acquired Xpediator, a fast-growing international freight management company, after a successful bid made in April. Xpediator provides freight-forwarding, logistics, and transport support solutions in the CEE and the UK under the Delamode brand. The consortium aims to further boost the company’s core freight-forwarding offers in Europe and internationally, as well as develop UK-based businesses.

04.07.2023

BaltCap completes the first take-private transaction by a Baltic investor on the London Stock Exchange by acquiring Xpediator

BaltCap, the largest private equity fund manager in the Baltics, with co-investors, acquired Xpediator, a fast-growing international freight management company, after a successful bid made in April. Xpediator provides freight-forwarding, logistics, and transport support solutions in the CEE and the UK under the Delamode brand. The consortium aims to further boost the company’s core freight-forwarding offers in Europe and internationally, as well as develop UK-based businesses.

04.07.2023

Raidierakstā 'Mediāna': Kāda ir valsts kapitāla sabiedrību un lielo uzņēmumu loma iespējkapitālā?

Sezonas pēdējā raidieraksta 'Mediāna' epizodē - saruna ar Tet.lv Korporatīvās attīstības direktoru Krists Avots.

02.07.2023

Raidierakstā 'Mediāna': Kāda ir valsts kapitāla sabiedrību un lielo uzņēmumu loma iespējkapitālā?

Sezonas pēdējā raidieraksta 'Mediāna' epizodē - saruna ar Tet.lv Korporatīvās attīstības direktoru Krists Avots.

02.07.2023

2022 Central and Eastern Europe Private Equity Statistics report is published

This report was compiled with the help of Invest Europe’s Central and Eastern Europe Task Force. It provides annual activity statistics for the private equity and venture capital markets of Central and Eastern Europe (CEE) in 2022 and prior years.

31.05.2023

2022 Central and Eastern Europe Private Equity Statistics report is published

This report was compiled with the help of Invest Europe’s Central and Eastern Europe Task Force. It provides annual activity statistics for the private equity and venture capital markets of Central and Eastern Europe (CEE) in 2022 and prior years.

31.05.2023

Iznākusi raidieraksta 'Mediāna' epizode par fondu finansējumu

Šonedēļ ir iznākusi jaunā raidieraksta 'Mediāna' epizode, kurā Kristaps Petersons sarunājas ar ALTUM valdes locekli Ieva Jansone-Buka par fondu finansējumu.

18.05.2023

Iznākusi raidieraksta 'Mediāna' epizode par fondu finansējumu

Šonedēļ ir iznākusi jaunā raidieraksta 'Mediāna' epizode, kurā Kristaps Petersons sarunājas ar ALTUM valdes locekli Ieva Jansone-Buka par fondu finansējumu.

18.05.2023

Baltic Private Equity and Venture Capital Market Overview 2022 has been published

Baltic Private Equity and Venture Capital Market Overview 2022 has been published.

This is a result of collaboration between Estonian Private Equity & Venture Capital Association (EstVCA), Latvian Private Equity and Venture Capital Association (LVCA), Lithuanian Private Equity and Venture Capital Association and KPMG Baltics for the 4th consecutive year.

18.05.2023

Baltic Private Equity and Venture Capital Market Overview 2022 has been published

Baltic Private Equity and Venture Capital Market Overview 2022 has been published.

This is a result of collaboration between Estonian Private Equity & Venture Capital Association (EstVCA), Latvian Private Equity and Venture Capital Association (LVCA), Lithuanian Private Equity and Venture Capital Association and KPMG Baltics for the 4th consecutive year.

18.05.2023

LVCA elects the new Board

This week members of LVCA have elected the new Board.

21.04.2023

LVCA elects the new Board

This week members of LVCA have elected the new Board.

21.04.2023

Insurer Balcia invests 1 million euros in the Merito Partners investment fund

The insurance technology company Balcia has invested 1 million euros in Merito

Sustainable Energy FUND I, an investment fund managed by Merito Partners (Merito) to

develop nine solar power plants across Latvia. Balcia has previously also invested in

renewable energy sector.

23.02.2023

Insurer Balcia invests 1 million euros in the Merito Partners investment fund

The insurance technology company Balcia has invested 1 million euros in Merito

Sustainable Energy FUND I, an investment fund managed by Merito Partners (Merito) to

develop nine solar power plants across Latvia. Balcia has previously also invested in

renewable energy sector.

23.02.2023

Merito Partners will invest 50 million euro in the development of ten solar power plants in Latvia

In order to increase Latvia's energy independence and the availability of green energy, the investment company Merito Partners (Merito) will invest 50 million euro and build ten new solar power plants (SPPs) in Latvia’s regions in the next two years. It is planned that at least eight SPPs with a total capacity of 55 MW will be operational by the end of this year.

05.02.2023

Merito Partners will invest 50 million euro in the development of ten solar power plants in Latvia

In order to increase Latvia's energy independence and the availability of green energy, the investment company Merito Partners (Merito) will invest 50 million euro and build ten new solar power plants (SPPs) in Latvia’s regions in the next two years. It is planned that at least eight SPPs with a total capacity of 55 MW will be operational by the end of this year.

05.02.2023

The self-service start-up TapBox has attracted investment from Merito Partners

The private equity fund of the Latvian investment company Merito Partners, founded last year, has made an investment in the self-service solution company TapBox, providing flexible growth capital for the development of the existing product and entry into new markets.

02.02.2023

The self-service start-up TapBox has attracted investment from Merito Partners

The private equity fund of the Latvian investment company Merito Partners, founded last year, has made an investment in the self-service solution company TapBox, providing flexible growth capital for the development of the existing product and entry into new markets.

02.02.2023

Saruna ar Ernestu Bordānu par iespējkapitālu raidierakstā 'Mediāna'

Altum sadarbībā ar Latvian Private Equity and Venture Capital Association (LVCA) iepazīstina ar jauno raidījuma Mediānas rubriku - “Iespējkapitāls”. Jaunākajā epizode skatāma saruna ar Ernestu Bordānu no Livonia Partners.

26.01.2023

Saruna ar Ernestu Bordānu par iespējkapitālu raidierakstā 'Mediāna'

Altum sadarbībā ar Latvian Private Equity and Venture Capital Association (LVCA) iepazīstina ar jauno raidījuma Mediānas rubriku - “Iespējkapitāls”. Jaunākajā epizode skatāma saruna ar Ernestu Bordānu no Livonia Partners.

26.01.2023

Baltic Private M&A Deal Points Study 2022 is out now

The seventh edition of “Baltic Private M&A Deal Points Study” has been published. The report gives a detailed overview of the Baltic mergers and acquisitions (M&A) market in comparison with previous periods.

19.01.2023

Baltic Private M&A Deal Points Study 2022 is out now

The seventh edition of “Baltic Private M&A Deal Points Study” has been published. The report gives a detailed overview of the Baltic mergers and acquisitions (M&A) market in comparison with previous periods.

19.01.2023

02.01.2023

02.01.2023

BaltCap to develop a €22 million Police Headquarters PPP project in Lithuania

BaltCap, the largest private equity firm in the Baltics, and the Police Department of Lithuania have signed a contract to design, build, finance and operate the new County Police Headquarters in Šiauliai, Lithuania. Total value of the signed public-private partnership (PPP) agreement is €21.9 million. BaltCap’s project company Safe Community takes on the task to complete the development of the new headquarters within 3 years and to provide facility maintenance and operation services for another 12 years.

02.01.2023

BaltCap to develop a €22 million Police Headquarters PPP project in Lithuania

BaltCap, the largest private equity firm in the Baltics, and the Police Department of Lithuania have signed a contract to design, build, finance and operate the new County Police Headquarters in Šiauliai, Lithuania. Total value of the signed public-private partnership (PPP) agreement is €21.9 million. BaltCap’s project company Safe Community takes on the task to complete the development of the new headquarters within 3 years and to provide facility maintenance and operation services for another 12 years.

02.01.2023

Livonia Partners exits Hortes

Hortes was sold to OU Hemm Arendus, controlled by Hortes management. The transaction also involved an investment of new funds into Hortes, allowing the company’s management to pursue their vision for further developing the concept of Hortes in Estonia.

01.12.2022

Livonia Partners exits Hortes

Hortes was sold to OU Hemm Arendus, controlled by Hortes management. The transaction also involved an investment of new funds into Hortes, allowing the company’s management to pursue their vision for further developing the concept of Hortes in Estonia.

01.12.2022

BaltCap enters the Latvian social and healthcare sector

BaltCap Private Equity Fund III (BPEF III), through its subsidiary Adoro, has signed an agreement to acquire the assets of Dzives Abece, a social care center in Latvia. With the investment, BaltCap aims to diversify the range of high-quality care services in Latvia for seniors and other client groups, such as post-treatment rehabilitation and dementia patients. Uldis Prieditis, a seasoned management professional, will serve as Adoro’s CEO.

14.11.2022

BaltCap enters the Latvian social and healthcare sector

BaltCap Private Equity Fund III (BPEF III), through its subsidiary Adoro, has signed an agreement to acquire the assets of Dzives Abece, a social care center in Latvia. With the investment, BaltCap aims to diversify the range of high-quality care services in Latvia for seniors and other client groups, such as post-treatment rehabilitation and dementia patients. Uldis Prieditis, a seasoned management professional, will serve as Adoro’s CEO.

14.11.2022

EIF Venture Capital Survey 2022

Market sentiment and impact of the current geopolitical & macroeconomic environment

30.09.2022

EIF Venture Capital Survey 2022

Market sentiment and impact of the current geopolitical & macroeconomic environment

30.09.2022

Throwback to Baltic VCA Summit 2022

This year the annual summit took place in Riga, Latvia. The theme was 'Cruising Through Rough Waters' - indicating the turbulent time that we currently live in and exploring how to get through different challenges - political instabilities, energy crisis, inflation and others. We were welcomed in the beautifully renovated museum-like Nordeki Manor where participants had a chance to engage in various activities throughout the day - listening to discussion, exploring industry news from experts, meeting each other, networking, enjoying lunch in the garden and most importantly - celebrate being in-person after the long period of Covid and lockdowns.

14.09.2022

Throwback to Baltic VCA Summit 2022

This year the annual summit took place in Riga, Latvia. The theme was 'Cruising Through Rough Waters' - indicating the turbulent time that we currently live in and exploring how to get through different challenges - political instabilities, energy crisis, inflation and others. We were welcomed in the beautifully renovated museum-like Nordeki Manor where participants had a chance to engage in various activities throughout the day - listening to discussion, exploring industry news from experts, meeting each other, networking, enjoying lunch in the garden and most importantly - celebrate being in-person after the long period of Covid and lockdowns.

14.09.2022

NCH’s Newly Formed Real Estate Fund Acquires its First Property

The alternative investment fund NCH Baltics Opportunity Fund I AIF has purchased its first industrial property for approx. 2.5 million euros in Riga, Buļļu Street 51b.

13.09.2022

NCH’s Newly Formed Real Estate Fund Acquires its First Property

The alternative investment fund NCH Baltics Opportunity Fund I AIF has purchased its first industrial property for approx. 2.5 million euros in Riga, Buļļu Street 51b.

13.09.2022

BaltCap to acquire Alma Littera Group, the leading publishing house & omnichannel book retailer in the Baltics

BaltCap Private Equity Fund III (BPEF III) signed an agreement to acquire Alma Littera publishing house, Pegasas bookstores, and related group companies to further back the growth of the largest publishing house & omnichannel book retailer in the Baltics. The current management team will continue with the company. The transaction is subject to competition clearance.

08.09.2022

BaltCap to acquire Alma Littera Group, the leading publishing house & omnichannel book retailer in the Baltics

BaltCap Private Equity Fund III (BPEF III) signed an agreement to acquire Alma Littera publishing house, Pegasas bookstores, and related group companies to further back the growth of the largest publishing house & omnichannel book retailer in the Baltics. The current management team will continue with the company. The transaction is subject to competition clearance.

08.09.2022

Livonia Partners closes second buy-out fund above target at €157 million

Rīga, Tallinn, and Vilnius, 8 September 2022;

Livonia Partners has raised €157 million for its second fund, cementing its position as a

leading private equity investor in the Baltic region.

23.08.2022

Livonia Partners closes second buy-out fund above target at €157 million

Rīga, Tallinn, and Vilnius, 8 September 2022;

Livonia Partners has raised €157 million for its second fund, cementing its position as a

leading private equity investor in the Baltic region.

23.08.2022

BALTIC VCA SUMMIT 2022

Private equity and venture capital industry experts will meet in Riga on the 25th and 26th of

August at the Baltic VCA Summit to discuss cooperation opportunities, the latest trends in private

equity and venture capital markets, share experiences in investing and raising capital, as well as

discuss the challenges and opportunities that arise from the current turbulent geopolitical and

financial circumstances.

06.07.2022

BALTIC VCA SUMMIT 2022

Private equity and venture capital industry experts will meet in Riga on the 25th and 26th of

August at the Baltic VCA Summit to discuss cooperation opportunities, the latest trends in private

equity and venture capital markets, share experiences in investing and raising capital, as well as

discuss the challenges and opportunities that arise from the current turbulent geopolitical and

financial circumstances.

06.07.2022

BaltCap sells Vendon to international technology group Azkoyen

BaltCap, the largest private equity and venture capital investor in the Baltics, sells Latvian company Vendon SIA to Azkoyen, Spain’s the most remarkable technology multinational company. Vendon SIA is part of Draugiem Group and is a leading company in connectivity and IoT solutions in digital payment and telemetry in Central Europe.

02.07.2022

BaltCap sells Vendon to international technology group Azkoyen

BaltCap, the largest private equity and venture capital investor in the Baltics, sells Latvian company Vendon SIA to Azkoyen, Spain’s the most remarkable technology multinational company. Vendon SIA is part of Draugiem Group and is a leading company in connectivity and IoT solutions in digital payment and telemetry in Central Europe.

02.07.2022

2021 Central and Eastern Europe Private Equity Statistics

Take a closer look at Baltic states from Venture Capital and Private Equity investments point of view:

- Baltic region received 21,4% of the total investment value in CEE in 2021.

- Estonia was the absolute leader in Private equity investments as a percentage of GDP with 1,574% from GDP, overrunning even Norway and the UK.

- Lithuania and Latvia were between leaders from the point of the divestments in 2018-2021.

You can find much more information in The Central and Eastern Europe Private Equity report, presented by Invest Europe.

30.06.2022

2021 Central and Eastern Europe Private Equity Statistics

Take a closer look at Baltic states from Venture Capital and Private Equity investments point of view:

- Baltic region received 21,4% of the total investment value in CEE in 2021.

- Estonia was the absolute leader in Private equity investments as a percentage of GDP with 1,574% from GDP, overrunning even Norway and the UK.

- Lithuania and Latvia were between leaders from the point of the divestments in 2018-2021.

You can find much more information in The Central and Eastern Europe Private Equity report, presented by Invest Europe.

30.06.2022

The Performance of European Private Equity Benchmark Report 2021

Invest Europe’s research delves deep into private equity performance. Our 2021 sample, provided by Cambridge Associates, includes 718 European Buy-Out, Growth, and Venture Capital funds, an increase of 47 from the 2020 sample. The report also compares European funds with international peers. On many measures, European private equity performs at least on a par with North American funds, and well ahead of funds from the rest of the world.

17.06.2022

The Performance of European Private Equity Benchmark Report 2021

Invest Europe’s research delves deep into private equity performance. Our 2021 sample, provided by Cambridge Associates, includes 718 European Buy-Out, Growth, and Venture Capital funds, an increase of 47 from the 2020 sample. The report also compares European funds with international peers. On many measures, European private equity performs at least on a par with North American funds, and well ahead of funds from the rest of the world.

17.06.2022

BaltCap and Nalka sell INTRAC to United Partners Investments

BaltCap Baltic Investment Fund III sells INTRAC Group, a leading distributor of machinery for forestry, construction, agriculture and industry in the Baltics, to United Partners Investments (UPI), a Baltic investment company. As a result of the transaction, UPI will acquire 100% of INTRAC Group, including shares of Nalka Invest and minority shareholders.

07.06.2022

BaltCap and Nalka sell INTRAC to United Partners Investments

BaltCap Baltic Investment Fund III sells INTRAC Group, a leading distributor of machinery for forestry, construction, agriculture and industry in the Baltics, to United Partners Investments (UPI), a Baltic investment company. As a result of the transaction, UPI will acquire 100% of INTRAC Group, including shares of Nalka Invest and minority shareholders.

07.06.2022

BaltCap sells Uprent to Renta, the fastest growing Nordic equipment rental company

BaltCap Private Equity Fund II (BPEF II) signed an agreement to sell SIA Uprent Group – a leading specialized pumping company providing dewatering and bypassing solutions in the Baltics and Poland – to Renta Group Oy. Renta Group is a Finnish construction machinery and equipment rental company with over 100 depots and 1,000 employees in Scandinavia and Europe. BaltCap will sell Uprent Group together with its minority shareholders. Renta Group will acquire 100% of the company.

07.06.2022

BaltCap sells Uprent to Renta, the fastest growing Nordic equipment rental company

BaltCap Private Equity Fund II (BPEF II) signed an agreement to sell SIA Uprent Group – a leading specialized pumping company providing dewatering and bypassing solutions in the Baltics and Poland – to Renta Group Oy. Renta Group is a Finnish construction machinery and equipment rental company with over 100 depots and 1,000 employees in Scandinavia and Europe. BaltCap will sell Uprent Group together with its minority shareholders. Renta Group will acquire 100% of the company.

07.06.2022

Baltic Private Equity and Venture Capital Market Overview 2021

Already for the third year in a row we are glad to present to you the annual summary of the Baltic market trends - Baltic Private Equity and Venture Capital Market Overview 2021! It is a result of a collaboration between all the Baltic VCA's and Deloitte and we are happy to finally share it with you. Full report and the webinar recording available from now on.

03.06.2022

Baltic Private Equity and Venture Capital Market Overview 2021

Already for the third year in a row we are glad to present to you the annual summary of the Baltic market trends - Baltic Private Equity and Venture Capital Market Overview 2021! It is a result of a collaboration between all the Baltic VCA's and Deloitte and we are happy to finally share it with you. Full report and the webinar recording available from now on.

03.06.2022

BaltCap Infrastructure Fund starts the construction of EUR 42 million wind farm

BaltCap Infrastructure Fund starts the construction of a EUR 42 million wind farm project in Lithuania. Six wind turbines with a total capacity of 30 MW will be installed in the Žvirgždaičiai, Šakiai district. The project will be financed by the fund’s investment of EUR 15 million, and a credit of EUR 27 million will be provided by Luminor bank.

20.05.2022

BaltCap Infrastructure Fund starts the construction of EUR 42 million wind farm

BaltCap Infrastructure Fund starts the construction of a EUR 42 million wind farm project in Lithuania. Six wind turbines with a total capacity of 30 MW will be installed in the Žvirgždaičiai, Šakiai district. The project will be financed by the fund’s investment of EUR 15 million, and a credit of EUR 27 million will be provided by Luminor bank.

20.05.2022

LVCA is looking for a part-time Assistant

LVCA is looking for a part-time Assistant who will work together with the Executive Director and the Board of the Association. This is a unique position that would provide a possibility to learn about Venture Capital and Private Equity industry in Latvia and the wider region and to participate in the development of the industry’s ecosystem.

10.04.2022

LVCA is looking for a part-time Assistant

LVCA is looking for a part-time Assistant who will work together with the Executive Director and the Board of the Association. This is a unique position that would provide a possibility to learn about Venture Capital and Private Equity industry in Latvia and the wider region and to participate in the development of the industry’s ecosystem.

10.04.2022

BaltCap invests in a global leader in internet privacy and security solutions

BaltCap together with lead investor Novator Ventures, General Catalyst and Burda Principal Investments participated in the $100M financing round to Nord Security, a global leader in internet privacy and security solutions, to expand the company’s product suite and enterprise footprint and accelerate the growth of its consumer cybersecurity segment.

04.04.2022

BaltCap invests in a global leader in internet privacy and security solutions

BaltCap together with lead investor Novator Ventures, General Catalyst and Burda Principal Investments participated in the $100M financing round to Nord Security, a global leader in internet privacy and security solutions, to expand the company’s product suite and enterprise footprint and accelerate the growth of its consumer cybersecurity segment.

04.04.2022

Winners of the Investor of the Year 2021 awards

The winners of the Investor of the Year'21 awards jointly organized by LVCA and LatBAN were announced on March 31. The main Investment of the Year award in the legal and institutional investor category was awarded to Bregal Sagemount for its investment in Printful, which enabled the company to reach a valuation of $1 billion and thus become the first unicorn in Latvia. Ģirts Līcis, Kārlis Cerbulis and Uldis Cērps won the Investment of the Year award in the business angel category for their joint investment in the new company WeedBot, which develops agricultural robots for the British market. The Growth Award went to Lokalise.

23.03.2022

Winners of the Investor of the Year 2021 awards

The winners of the Investor of the Year'21 awards jointly organized by LVCA and LatBAN were announced on March 31. The main Investment of the Year award in the legal and institutional investor category was awarded to Bregal Sagemount for its investment in Printful, which enabled the company to reach a valuation of $1 billion and thus become the first unicorn in Latvia. Ģirts Līcis, Kārlis Cerbulis and Uldis Cērps won the Investment of the Year award in the business angel category for their joint investment in the new company WeedBot, which develops agricultural robots for the British market. The Growth Award went to Lokalise.

23.03.2022

BaltCap enters the pet care market to boost Pan-Baltic growth of the sector

BaltCap Growth Fund, together with I Asset Management, a Lithuanian private equity firm, entered the veterinary market by investing in Dr. VET, which operates five veterinary clinics in Vilnius. IAM Petcare Growth Fund acquired 65% of the shares of Vet Ventures, a holding company of the clinics, BaltCap Growth Fund's stake is 35%. New owners seek growth through organic expansion opportunities and further acquisition targets in the Baltics and neighboring countries.

21.03.2022

BaltCap enters the pet care market to boost Pan-Baltic growth of the sector

BaltCap Growth Fund, together with I Asset Management, a Lithuanian private equity firm, entered the veterinary market by investing in Dr. VET, which operates five veterinary clinics in Vilnius. IAM Petcare Growth Fund acquired 65% of the shares of Vet Ventures, a holding company of the clinics, BaltCap Growth Fund's stake is 35%. New owners seek growth through organic expansion opportunities and further acquisition targets in the Baltics and neighboring countries.

21.03.2022

LVCA valdes loceklis Edgars Pīgoznis ievēlēts LDDK vadībā

Latvijas Darba devēju konfederācijas ikgadējā biedru sapulcē 18.martā tika pārvēlēta LDDK padome. Apsveicam LDDK ar jaunu padomi un priecājamies, ka LVCA valdes loceklis Edgars Pīgoznis saskaņā ar sapulces lēmumu ievēlēts par vienu no LDDK viceprezidentiem.

14.03.2022

LVCA valdes loceklis Edgars Pīgoznis ievēlēts LDDK vadībā

Latvijas Darba devēju konfederācijas ikgadējā biedru sapulcē 18.martā tika pārvēlēta LDDK padome. Apsveicam LDDK ar jaunu padomi un priecājamies, ka LVCA valdes loceklis Edgars Pīgoznis saskaņā ar sapulces lēmumu ievēlēts par vienu no LDDK viceprezidentiem.

14.03.2022

Noskaidroti nominanti apbalvojumam par 2021. gada Latvijas nozīmīgākajām investīcijām

Latvijas Biznesa Eņģeļu Tīkls (LatBAN) un Latvijas Privātā un riska kapitāla asociācija (LVCA) noteikuši nominantus apbalvojumam “Gada investors 2021” par pērnā gada Latvijas nozīmīgākajām investīcijām industrijā. Uz apbalvojumu pretendē gan privātie investori (komerceņģeļi), gan juridiskie un institucionālie investori, gan privātā un riska kapitāla darījumu konsultanti.

11.03.2022

Noskaidroti nominanti apbalvojumam par 2021. gada Latvijas nozīmīgākajām investīcijām

Latvijas Biznesa Eņģeļu Tīkls (LatBAN) un Latvijas Privātā un riska kapitāla asociācija (LVCA) noteikuši nominantus apbalvojumam “Gada investors 2021” par pērnā gada Latvijas nozīmīgākajām investīcijām industrijā. Uz apbalvojumu pretendē gan privātie investori (komerceņģeļi), gan juridiskie un institucionālie investori, gan privātā un riska kapitāla darījumu konsultanti.

11.03.2022

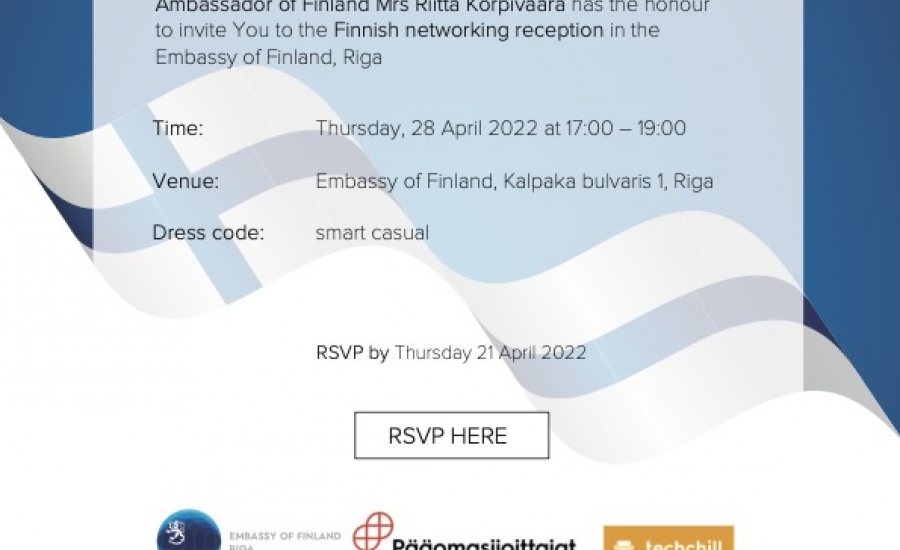

Finnish networking reception in collaboration with TechChil

Finnish networking reception will be organized in the Embassy of Finland during TechChill 2022 on Thursday, April 28, 17:00-19:00. In addition to Finnish participants, the networking will include selected Latvian startups, LVCA members and management and Norwegian VCs and growth companies part of Oslo Business Region attendees in Techchill.

07.03.2022

Finnish networking reception in collaboration with TechChil

Finnish networking reception will be organized in the Embassy of Finland during TechChill 2022 on Thursday, April 28, 17:00-19:00. In addition to Finnish participants, the networking will include selected Latvian startups, LVCA members and management and Norwegian VCs and growth companies part of Oslo Business Region attendees in Techchill.

07.03.2022

CBL Asset Management Active Pension Plan makes first foray into VC

CBL Asset Management Active Pension Plan has committed €5m to Change Ventures Fund II.

28.02.2022

CBL Asset Management Active Pension Plan makes first foray into VC

CBL Asset Management Active Pension Plan has committed €5m to Change Ventures Fund II.

28.02.2022

LVCA statement on the situation in Ukraine

The war in Ukraine is the greatest tragedy since World War II. We at the Latvian Private Equity and Venture Capital Association (LVCA) stand with all Ukrainians and call for an immediate stop to the aggression.

21.02.2022

LVCA statement on the situation in Ukraine

The war in Ukraine is the greatest tragedy since World War II. We at the Latvian Private Equity and Venture Capital Association (LVCA) stand with all Ukrainians and call for an immediate stop to the aggression.

21.02.2022

Investori aicināti pieteikties apbalvojumam “Gada investors 2021”

LVCA un LatBAN un izsludina pieteikšanos apbalvojumam “Gada investors 2021” par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Iniciatīva “Gada investors” tika dibināta 2015. gadā, lai veicinātu Latvijas investīciju nozares attīstību, apkopotu investoru paveikto, godinātu investorus un izceltu nozares atbalstītājus, kuri snieguši būtisku ieguldījumu Latvijas investīciju vides un uzņēmējdarbības attīstībā.

07.02.2022

Investori aicināti pieteikties apbalvojumam “Gada investors 2021”

LVCA un LatBAN un izsludina pieteikšanos apbalvojumam “Gada investors 2021” par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Iniciatīva “Gada investors” tika dibināta 2015. gadā, lai veicinātu Latvijas investīciju nozares attīstību, apkopotu investoru paveikto, godinātu investorus un izceltu nozares atbalstītājus, kuri snieguši būtisku ieguldījumu Latvijas investīciju vides un uzņēmējdarbības attīstībā.

07.02.2022

SAVE THE DATE: Baltic VCA Summit 2022

There’s no hiking required for our summit, but catching up with our PE/VC colleagues from the Baltics and further afield also promises to open up new horizons.

Join us in Riga and we’ll do exactly that, together, at one of the most anticipated industry events in the region this summer.

So please mark the event in your calendars and plan to attend this August.

02.02.2022

SAVE THE DATE: Baltic VCA Summit 2022

There’s no hiking required for our summit, but catching up with our PE/VC colleagues from the Baltics and further afield also promises to open up new horizons.

Join us in Riga and we’ll do exactly that, together, at one of the most anticipated industry events in the region this summer.

So please mark the event in your calendars and plan to attend this August.

02.02.2022

BaltCap sells Baltic property manager BPT Real Estate to leading European property house Newsec

BaltCap Private Equity Fund II (BPEF II) sells a 95% majority stake in AS BPT Real Estate, one of the largest property management companies in the Baltics, to Newsec, a leading full-service property house offering property asset management and advisory across Northern Europe. This is the 6th exit of BPEF II.

20.01.2022

BaltCap sells Baltic property manager BPT Real Estate to leading European property house Newsec

BaltCap Private Equity Fund II (BPEF II) sells a 95% majority stake in AS BPT Real Estate, one of the largest property management companies in the Baltics, to Newsec, a leading full-service property house offering property asset management and advisory across Northern Europe. This is the 6th exit of BPEF II.

20.01.2022

Livonia Partners invests in Bestair Group and Zave Group

Livonia Partners has made an investment in Bestair Group and Zave Group, which are leading providers of green home climate solutions, operating in B2B and B2C segments in 8 different countries. This is the second investment by Livonia Partners out of its second fund, which aims to invest into companies and opportunities addressing climate change and environmental sustainability.

19.01.2022

Livonia Partners invests in Bestair Group and Zave Group

Livonia Partners has made an investment in Bestair Group and Zave Group, which are leading providers of green home climate solutions, operating in B2B and B2C segments in 8 different countries. This is the second investment by Livonia Partners out of its second fund, which aims to invest into companies and opportunities addressing climate change and environmental sustainability.

19.01.2022

Poland & CEE Private Equity Conference

On May 10th top industry professionals and asset managers are gathering together for the 8th edition of the Poland & CEE Private Equity Conference. Meet 300+ handpicked attendees including prominent private equity investors across the CEE region, as well as global asset managers and get their groundbreaking perspectives.

04.01.2022

Poland & CEE Private Equity Conference

On May 10th top industry professionals and asset managers are gathering together for the 8th edition of the Poland & CEE Private Equity Conference. Meet 300+ handpicked attendees including prominent private equity investors across the CEE region, as well as global asset managers and get their groundbreaking perspectives.

04.01.2022

BaltCap Infrastructure Fund will finance greenfield biomass CHP construction in Alytus

BaltCap Infrastructure Fund (BInF) is providing a loan of EUR 6 million via its subsidiary Forest Investment to construct a biomass combined heat and power plant in Alytus. The project is being developed by the local company Biovatas. It is planned that the powerplant will start the production of heat and electricity in 2023.

08.11.2021

BaltCap Infrastructure Fund will finance greenfield biomass CHP construction in Alytus

BaltCap Infrastructure Fund (BInF) is providing a loan of EUR 6 million via its subsidiary Forest Investment to construct a biomass combined heat and power plant in Alytus. The project is being developed by the local company Biovatas. It is planned that the powerplant will start the production of heat and electricity in 2023.

08.11.2021

Webinar video recording "Sustainable investments from the perspective of venture and private equity managers"

In the webinar, we covered sustainable investments from the perspective of venture and private equity managers. What is the current and desired practices? Examples to learn from? And what is mandatory in this regard?

10.09.2021

Webinar video recording "Sustainable investments from the perspective of venture and private equity managers"

In the webinar, we covered sustainable investments from the perspective of venture and private equity managers. What is the current and desired practices? Examples to learn from? And what is mandatory in this regard?

10.09.2021

Latvijas uzņēmumiem pieejamas vēsturiski lielākās izaugsmes investīcijas gandrīz miljarda eiro apjomā

Tuvāko gadu laikā Latvijas uzņēmumiem pieejamas izaugsmes kapitāla investīcijas aptuveni

850 miljonu eiro apjomā no Latvijā reģistrētajiem privātā un riska kapitāla fondiem un citviet

bāzētiem fondiem ar interesi Baltijas uzņēmumos, informē Latvijas Privātā un Riska un

kapitāla asociācija (LVCA).

07.09.2021

Latvijas uzņēmumiem pieejamas vēsturiski lielākās izaugsmes investīcijas gandrīz miljarda eiro apjomā

Tuvāko gadu laikā Latvijas uzņēmumiem pieejamas izaugsmes kapitāla investīcijas aptuveni

850 miljonu eiro apjomā no Latvijā reģistrētajiem privātā un riska kapitāla fondiem un citviet

bāzētiem fondiem ar interesi Baltijas uzņēmumos, informē Latvijas Privātā un Riska un

kapitāla asociācija (LVCA).

07.09.2021

Vebinārs: Kā diversificēt savus ieguldījumus ar investīcijām privātā kapitāla fondos?

Private equity jeb privātā kapitāla fondi pēdējās desmitgadēs ir spējuši nodrošināt būtiski augstāku ienesīgumu nekā ieguldījumi publiskajos tirgos*. Pensiju fondi, apdrošināšanas sabiedrības, turīgas privātpersonas (HNWI) ārvalstīs aktīvi izmanto iespējas investēt šādos fondos. Latvijas investori līdz šim maz izmantojuši šo iespēju gan zināšanu, gan pieredzes trūkuma dēļ.

Lai mazinātu šo šķērsli, vebinārā iepazīstināsim ar tipiskākajiem šāda ieguldījuma juridiskajiem aspektiem. Stāstīsim arī par atšķirīgajiem statusiem, kādos iespējams kļūt par investoru privātā kapitāla tirgū. Dalīsimies arī ar European Investment Fund pieredzi ar ieguldījumiem privātā kapitāla fondos, to atdevi un, kā EIF ieguldījumi kalpo kā “drošības zīme” citu investoru piesaistei.

30.08.2021

Vebinārs: Kā diversificēt savus ieguldījumus ar investīcijām privātā kapitāla fondos?

Private equity jeb privātā kapitāla fondi pēdējās desmitgadēs ir spējuši nodrošināt būtiski augstāku ienesīgumu nekā ieguldījumi publiskajos tirgos*. Pensiju fondi, apdrošināšanas sabiedrības, turīgas privātpersonas (HNWI) ārvalstīs aktīvi izmanto iespējas investēt šādos fondos. Latvijas investori līdz šim maz izmantojuši šo iespēju gan zināšanu, gan pieredzes trūkuma dēļ.

Lai mazinātu šo šķērsli, vebinārā iepazīstināsim ar tipiskākajiem šāda ieguldījuma juridiskajiem aspektiem. Stāstīsim arī par atšķirīgajiem statusiem, kādos iespējams kļūt par investoru privātā kapitāla tirgū. Dalīsimies arī ar European Investment Fund pieredzi ar ieguldījumiem privātā kapitāla fondos, to atdevi un, kā EIF ieguldījumi kalpo kā “drošības zīme” citu investoru piesaistei.

30.08.2021

Apmācības "Aktuālais un noderīgais AML un starptautisko sankciju piemērošanā”

Aicinam uz apmācībām "Aktuālais un noderīgais AML un starptautisko sankciju piemērošanā”, kas notiks 23.septembrī no plkst.10:00 - 12:30 attālināti ZOOM platformā.

19.08.2021

Apmācības "Aktuālais un noderīgais AML un starptautisko sankciju piemērošanā”

Aicinam uz apmācībām "Aktuālais un noderīgais AML un starptautisko sankciju piemērošanā”, kas notiks 23.septembrī no plkst.10:00 - 12:30 attālināti ZOOM platformā.

19.08.2021

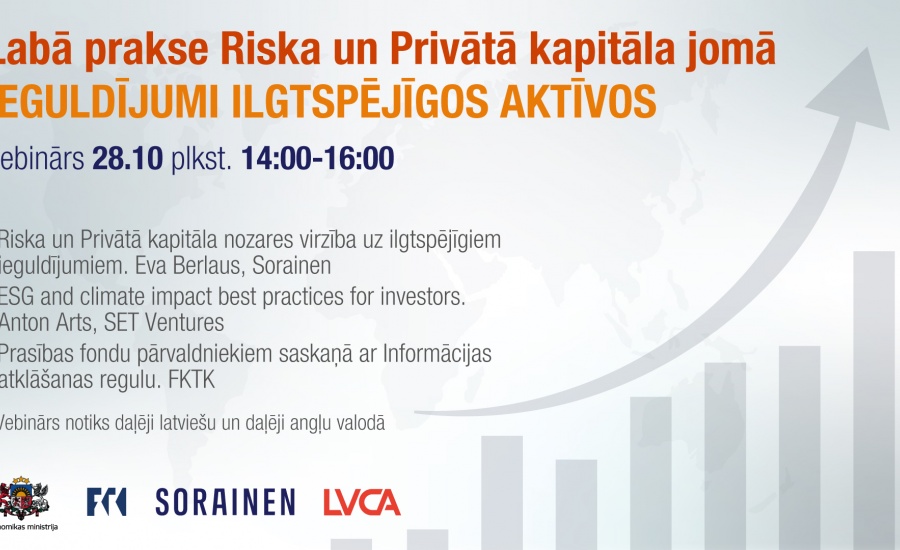

Labā prakse Riska un Privātā kapitāla jomā. Ieguldījumi ilgtspējīgos aktīvos

Ar prieku aicinām uz vebināru "Labā prakse Riska un Privātā kapitāla jomā. Ieguldījumi ilgtspējīgos aktīvos" 28.10 plkst.14:00-16:00.

07.07.2021

Labā prakse Riska un Privātā kapitāla jomā. Ieguldījumi ilgtspējīgos aktīvos

Ar prieku aicinām uz vebināru "Labā prakse Riska un Privātā kapitāla jomā. Ieguldījumi ilgtspējīgos aktīvos" 28.10 plkst.14:00-16:00.

07.07.2021

Baltic Private Equity and Venture Capital Market Overview 2020

Baltic VCAs and Deloitte are honored to present the Baltic Private Equity and Venture Capital Market Overview 2020, which has been prepared by the parties for the second year running. The report features insights into the Baltic market trends, fundraising, investments, divestments, and much more.

01.07.2021

Baltic Private Equity and Venture Capital Market Overview 2020

Baltic VCAs and Deloitte are honored to present the Baltic Private Equity and Venture Capital Market Overview 2020, which has been prepared by the parties for the second year running. The report features insights into the Baltic market trends, fundraising, investments, divestments, and much more.

01.07.2021

Private equity invests in record 566 CEE companies in 2020

Invest Europe, the association representing Europe’s private equity, venture capital and infrastructure sectors released its 2020 Central and Eastern Europe Private Equity Statistics. The report shows that Private equity firms invested in a record 566 companies in Central and Eastern Europe in 2020, as the industry supported dynamic SMEs and start-ups that will fuel the recovery from the impact of COVID-19 and underpin long-term economic and social development across the region. 2020 was second-best year for VC investment and private equity exits across the region.

01.06.2021

Private equity invests in record 566 CEE companies in 2020

Invest Europe, the association representing Europe’s private equity, venture capital and infrastructure sectors released its 2020 Central and Eastern Europe Private Equity Statistics. The report shows that Private equity firms invested in a record 566 companies in Central and Eastern Europe in 2020, as the industry supported dynamic SMEs and start-ups that will fuel the recovery from the impact of COVID-19 and underpin long-term economic and social development across the region. 2020 was second-best year for VC investment and private equity exits across the region.

01.06.2021

Livonia Partners signs an agreement to sell majority stake in Santa Monica Networks to LMT

Livonia Partners and minority shareholders in Santa Monica Networks, the networking and IT security solutions provider in Latvia and Lithuania, signed an agreement to sell their shares in Santa Monica Networks to Latvijas Mobilais Telefons Ltd. (LMT). LMT will become a 100% owner of Santa Monica Networks. Completion of the transaction depends on approvals from the market regulators in Latvia and Lithuania.

27.05.2021

Livonia Partners signs an agreement to sell majority stake in Santa Monica Networks to LMT

Livonia Partners and minority shareholders in Santa Monica Networks, the networking and IT security solutions provider in Latvia and Lithuania, signed an agreement to sell their shares in Santa Monica Networks to Latvijas Mobilais Telefons Ltd. (LMT). LMT will become a 100% owner of Santa Monica Networks. Completion of the transaction depends on approvals from the market regulators in Latvia and Lithuania.

27.05.2021

Private Equity at Work report

Detailed evidence and analysis of the European private equity industry’s real contribution to employment, in 2019, and job creation, in 2018-19, and the far-reaching impact this has on the people, societies and economies of Europe.

27.05.2021

Private Equity at Work report

Detailed evidence and analysis of the European private equity industry’s real contribution to employment, in 2019, and job creation, in 2018-19, and the far-reaching impact this has on the people, societies and economies of Europe.

27.05.2021

Women in private equity and venture capital in the Baltics 2021

We are happy to see the first-ever report highlighting the most inspiring and successful woman shaping and leading the PE/VC industry in the Baltics!

21.05.2021

Women in private equity and venture capital in the Baltics 2021

We are happy to see the first-ever report highlighting the most inspiring and successful woman shaping and leading the PE/VC industry in the Baltics!

21.05.2021

New Nordic Cooperation Between Finland and Latvia

Recently Finnish Venture Capital Association and LVCA joined forces to create working-level cooperation that for both sides would broaden investments’ geography and bring new opportunities closer.

The next event will be held in autumn; stay tuned.

20.05.2021

New Nordic Cooperation Between Finland and Latvia

Recently Finnish Venture Capital Association and LVCA joined forces to create working-level cooperation that for both sides would broaden investments’ geography and bring new opportunities closer.

The next event will be held in autumn; stay tuned.

20.05.2021

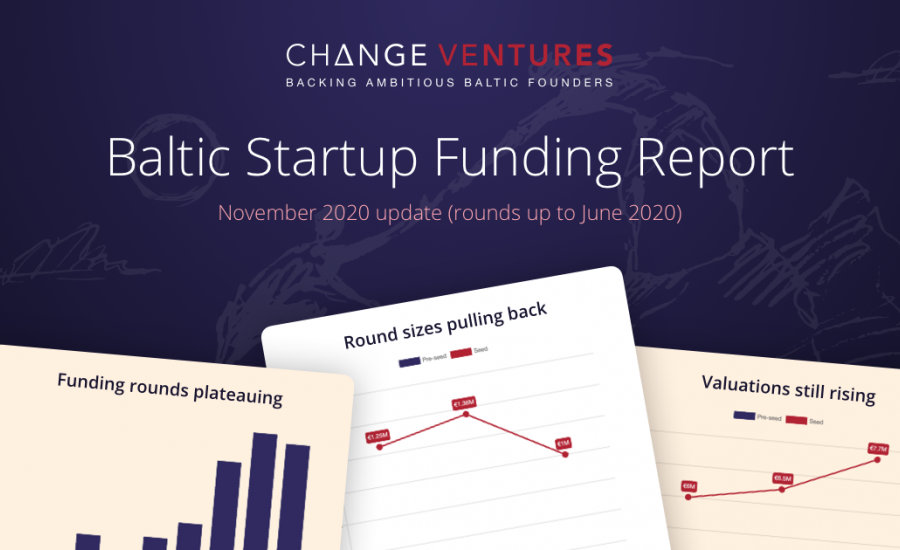

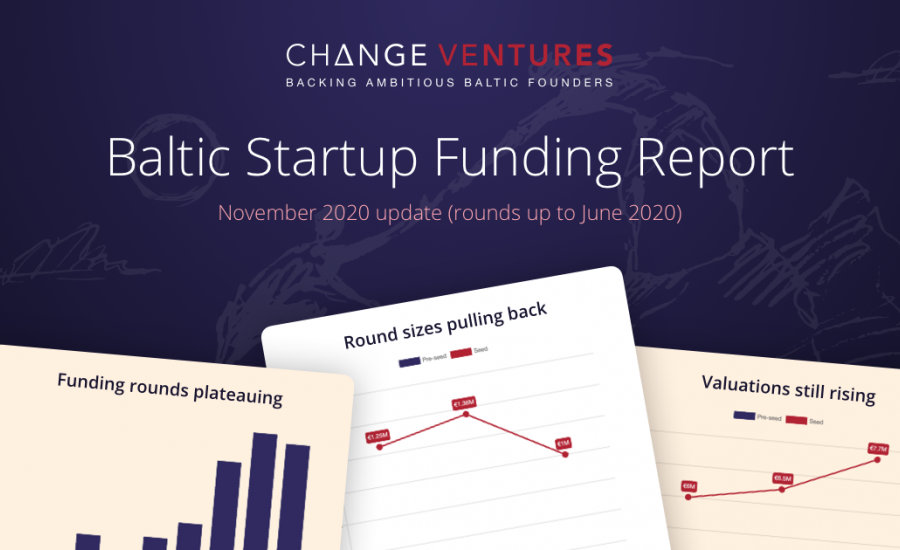

Baltic Startup Funding Report

Change Ventures Baltic Startup Funding Report is a semi-annual publication of detailed data about funding rounds for startups in the Baltics, including companies with HQs elsewhere but with a dominant base in Estonia, Latvia or Lithuania.

20.05.2021

Baltic Startup Funding Report

Change Ventures Baltic Startup Funding Report is a semi-annual publication of detailed data about funding rounds for startups in the Baltics, including companies with HQs elsewhere but with a dominant base in Estonia, Latvia or Lithuania.

20.05.2021

Izaugsmes kapitāls biznesa uzrāvienam: Vigo Health stāsts

Riska kapitāls un biznesa eņģeļi palīdz vērtīgām idejām kļūt par vērtīgiem uzņēmumiem.Latvijā radīts produkts palīdzēs insulta pacientiem visā pasaulē!

Šobrīd uzņēmums Vigo Health Latvija piedāvā personalizētu digitālās terapijas programmu pacientiem, kuri pārcietuši insultu. Uzņēmums ir Commercialization Reactor absolvents.

18.05.2021

Izaugsmes kapitāls biznesa uzrāvienam: Vigo Health stāsts

Riska kapitāls un biznesa eņģeļi palīdz vērtīgām idejām kļūt par vērtīgiem uzņēmumiem.Latvijā radīts produkts palīdzēs insulta pacientiem visā pasaulē!

Šobrīd uzņēmums Vigo Health Latvija piedāvā personalizētu digitālās terapijas programmu pacientiem, kuri pārcietuši insultu. Uzņēmums ir Commercialization Reactor absolvents.

18.05.2021

Kā riska kapitāls palīdz augt uzņēmumiem?

Sonarworks ir Latvijas audio tehnoloģiju uzņēmums, kas izstrādājis unikālu kalibrēšanas ierīci skandām un austiņām, un viņa produktus izmanto pasaules mūzikas superzvaigznes!

Sonarworks veiksmes formula var noderēt arī citu izaugsmei!

Skaties video un uzzini vairāk!

10.05.2021

Kā riska kapitāls palīdz augt uzņēmumiem?

Sonarworks ir Latvijas audio tehnoloģiju uzņēmums, kas izstrādājis unikālu kalibrēšanas ierīci skandām un austiņām, un viņa produktus izmanto pasaules mūzikas superzvaigznes!

Sonarworks veiksmes formula var noderēt arī citu izaugsmei!

Skaties video un uzzini vairāk!

10.05.2021

FUNDING IN THE CEE REGION THROUGH THE LENS OF GENDER DIVERSITY AND POSITIVE IMPACT

European Women in VC together with Experior VC and Unconventional Ventures have launched “Funding in CEE region report – through the lens of gender diversity and positive impact”.

Please see full report here.

10.05.2021

FUNDING IN THE CEE REGION THROUGH THE LENS OF GENDER DIVERSITY AND POSITIVE IMPACT

European Women in VC together with Experior VC and Unconventional Ventures have launched “Funding in CEE region report – through the lens of gender diversity and positive impact”.

Please see full report here.

10.05.2021

Investing in Europe: Private Equity activity 2020

Invest Europe's new report 'Investing in Europe: 2020 Private Equity Activity' provides with new analyses including first time funds and holding periods by strategy.

The report shows resilient private equity activity in 2020 in the face of the COVID-19 pandemic, with the second highest investment level on record, and fundraising over €100 billion for the third year running.

04.03.2021

Investing in Europe: Private Equity activity 2020

Invest Europe's new report 'Investing in Europe: 2020 Private Equity Activity' provides with new analyses including first time funds and holding periods by strategy.

The report shows resilient private equity activity in 2020 in the face of the COVID-19 pandemic, with the second highest investment level on record, and fundraising over €100 billion for the third year running.

04.03.2021

Investoriem šis gads solās būt pozitīvs

LVCA valdes loceklis Rūdolfs Krese intervijā laikrakstam Diena: "Investoriem šis gads solās būt pozitīvs"

02.03.2021

Investoriem šis gads solās būt pozitīvs

LVCA valdes loceklis Rūdolfs Krese intervijā laikrakstam Diena: "Investoriem šis gads solās būt pozitīvs"

02.03.2021

Izaugsmes kapitāla industrija rada iespējas uzņēmumiem augt pat Covid-19 krīzes laikā

Pērnais gads ir atstājis savu nospiedumu visās jomās, arī investīciju vidē. Dažas nozares, it sevišķi tās, kurās dominē klātienes pakalpojumi/preču pārdošana, ir uz izdzīvošanas sliekšņa. Vienlaikus novērojam, ka daudzi uzņēmumi, kuri eksportē, nodrošina attālinātus pakalpojumus vai strādā šādā režīmā, pabeiguši 2020. gadu pat labāk nekā cerēts.

26.02.2021

Izaugsmes kapitāla industrija rada iespējas uzņēmumiem augt pat Covid-19 krīzes laikā

Pērnais gads ir atstājis savu nospiedumu visās jomās, arī investīciju vidē. Dažas nozares, it sevišķi tās, kurās dominē klātienes pakalpojumi/preču pārdošana, ir uz izdzīvošanas sliekšņa. Vienlaikus novērojam, ka daudzi uzņēmumi, kuri eksportē, nodrošina attālinātus pakalpojumus vai strādā šādā režīmā, pabeiguši 2020. gadu pat labāk nekā cerēts.

26.02.2021

“Nordic-Baltic PE/VC Momentum 2021” virtual conference

On 17 February 2021 the “Nordic-Baltic PE/VC Momentum 2021” virtual conference was held with hours of interesting discussions and topics covered. LVCA chairwoman Kristīne Bērziņa took part in panel ''Nordic-Baltic LP activity - what's the next big leap?"

23.02.2021

“Nordic-Baltic PE/VC Momentum 2021” virtual conference

On 17 February 2021 the “Nordic-Baltic PE/VC Momentum 2021” virtual conference was held with hours of interesting discussions and topics covered. LVCA chairwoman Kristīne Bērziņa took part in panel ''Nordic-Baltic LP activity - what's the next big leap?"

23.02.2021

Izaugsmes kapitāls-iespēja augt pat krīzes laikā

LVCA valdes priekšsēdētājas Kristīnes Bērziņas viedokļa raksts "Izaugsmes kapitāls-iespēja augt pat krīzes laikā" lasāms 23.02 Latvijas Avīze pielikumā Latvijas Bizness.

Kristīne Bērziņa: "Šobrīd ir īstais laiks uzdrošināties, uzmeklēt investoru un ķerties pie drosmīgu ideju īstenošanas."

12.02.2021

Izaugsmes kapitāls-iespēja augt pat krīzes laikā

LVCA valdes priekšsēdētājas Kristīnes Bērziņas viedokļa raksts "Izaugsmes kapitāls-iespēja augt pat krīzes laikā" lasāms 23.02 Latvijas Avīze pielikumā Latvijas Bizness.

Kristīne Bērziņa: "Šobrīd ir īstais laiks uzdrošināties, uzmeklēt investoru un ķerties pie drosmīgu ideju īstenošanas."

12.02.2021

Noskaidroti Latvijas 2020. gada veiksmīgākie investori

Latvijas Privātā un riska kapitāla asociācija (LVCA) un Latvijas Biznesa Eņģeļu Tīkls (LatBAN) 11. februārī pasniedza “Gada investors 2020” apbalvojumus par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Balvu “Gada investīcija” privāto investoru sektorā saņēma Kārlis Cerbulis par investīciju digitālajā rehabilitācijas programmā pēc insulta “Vigo Health”. Par “Gada investīciju” investīciju fondu un korporatīvo investoru sektorā atzīta “INVL Baltic Sea Growth Fund” investīcija vides apsaimniekošanas uzņēmumu grupā “Eco Baltia”.

31.01.2021

Noskaidroti Latvijas 2020. gada veiksmīgākie investori

Latvijas Privātā un riska kapitāla asociācija (LVCA) un Latvijas Biznesa Eņģeļu Tīkls (LatBAN) 11. februārī pasniedza “Gada investors 2020” apbalvojumus par aizvadītā gada nozīmīgākajām investīcijām Latvijā. Balvu “Gada investīcija” privāto investoru sektorā saņēma Kārlis Cerbulis par investīciju digitālajā rehabilitācijas programmā pēc insulta “Vigo Health”. Par “Gada investīciju” investīciju fondu un korporatīvo investoru sektorā atzīta “INVL Baltic Sea Growth Fund” investīcija vides apsaimniekošanas uzņēmumu grupā “Eco Baltia”.

31.01.2021

Aicinām uz Gada Investors 2020 ceremoniju

Aicinām uz Gada Investors 2020 ceremoniju 11.februārī no pl.16:00-18:00.

29.01.2021

Aicinām uz Gada Investors 2020 ceremoniju

Aicinām uz Gada Investors 2020 ceremoniju 11.februārī no pl.16:00-18:00.

29.01.2021

Nordic-Baltic PE/VC MOMENTUM 2021 conference

The Nordic-Baltic region has been exceedingly successful in building world-class startups, scaleups and ecosystems to support this growth. The Nordic-Baltic PE/VC MOMENTUM 2021 conference takes a step further with regional thought leaders analysing what could be the next chapter for the regions' ecosystem innovation to flourish. Join us for a half-day conference on February 17th, 2021 to discuss the ecosystem development strategies with the largest LP-s, GP-s and other regional key players.

11.01.2021

Nordic-Baltic PE/VC MOMENTUM 2021 conference